Best Installment Loans For Gig Workers

For hardworking gig workers, 1099 workers, independent contractors, freelancers, and self-employed, obtaining bank loans might be more complex than individuals holding traditional W-2 employment. However, at GigsPayday, top lenders accept gig income and offer the best installment loans available to gig workers and self-employed. Such gig loans provide them with financial support and help them stand up again.

Gig Worker Loans

Cash Advance Loans

Payday Loans

Hustling In the Gig Economy? Getting Credit Could Be Your Biggest Hurdle

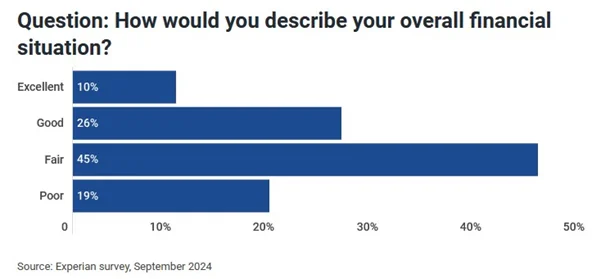

Experian surveyed 752 gig economy workers independently about their financial difficulties. Here are the 10 points:

- Irregular income complicates credit access for non-traditional workers.

- Gig workers who are dependent on gigs view credit access as being more complex to get.

- Just 52% of gig-dependent workers say credit is easy, versus 72% among less gig-dependent workers.

- Gig workers experience financial pressure from work-related costs, exacerbating credit issues.

- Creditors frequently demand work and income information, even though credit scores ignore them.

- Income variability impacts gig workers' ability to access all forms of credit, from cards to mortgages.

- The finance and tech industries are solving gig workers' credit difficulties with customized solutions.

- New financial products such as direct deposit and BNPL plans meet gig workers' requirements.

- The unpredictable incomes of gig workers conflict with conventional credit assessment models.

- Gig workers' distinct finances inspire financial product and service innovation.

Source: Experian Search

McKinsey's Report Says Gig Workers Struggle with Financial Exclusion

Did you know? Approx. 36% of U.S. workers are engaging in the gig economy, either as their primary job, or as a part-time to earn extra. According the McKinsey's 2022 American Opportunity Survey clearly shows that 36% gig workers and self-employed individuals are facing higher economic anxiety as compare to full-time workers.

The gig economy offers work flexibility, but most of the gig workers tend to be "Credit Invisible" because of its unique work and income style. Unlike regular W-2 employment who earn regular income and other benefits such as insurance, gig workers usually earn irregular income. This unstable income stream makes it difficult for them to qualify for regular credit options like bank loan or credit cards.

In real world, most of the gig economy workers are depend upon non-reporting cash payments, which limit their visibility under the credit ecosystem. Consequently, all these factors affected gig workers to maintain a sound credit file, resultant, they can't access low-cost credit options.

Are Installment Loans for Gig Workers Really a Financial Lifeline for The Gig Economy?

Today, millions of Americans are enrolled in the gig economy and are attracted to its work flexibility and sense of being boss of yourself. It might be good, but irregular income flow and lack of other benefits make it difficult to cover their unexpected expenses or investments to keep going the gig activities.

Banks won't accept gig workers, self-employed, and independent contractors, but thank God; private lenders feel the financial pain of millions of gig workers. They accept gig income and all credit types and offer installment loans, cash advance loans, payday loans, and other loans for hardworking gig workers.

Unlike bank loans and other traditional short-term loans, installment loans offer loans ranging from $2,500 to $5,000 with a more extended and manageable repayment structure. With installment loans, gig workers get enough breathing room to repay on time, even if their income fluctuates. GigsPayday has a broad panel of 40+ lenders who accept gig income and all financial profiles, including flawed credit individuals.

Why Gig Workers Need Installment loans?

In the gig economy reality world, gig workers face precarious employment, low wages, and lack of employment benefits like retirement plans and insurance. For instance, a slow week can lower Uber or Lyft drivers' earnings. Likewise, a pending freelance project can create a cash flow problem.

Additionally, conventional banks and lenders won't accept gig workers and self-employed people to borrow money because of their low income or lack of a steady income stream. The unavailability of W-2 forms and a bad credit profile can worsen the situation. At this time, dedicated installment loans for gig workers act like a "Super Hero" for them.

What you get by opting for the best installment loans are:

- Fast cash output for emergencies: Unlike bank loans, once your loan is approved, you will get money in your bank account within minutes*, making it perfect for financial emergencies.

- Flexible and manageable repayments: You can borrow large amounts of money and later spread the cost of your loan by fixed installments. It is a better option for gig workers with unpredictable income flow.

- Anytime accessibility: Due to the high demand for credit products dedicated to the gig economy community. Many lenders now accept alternative income proof like a 1099 form or bank statements.

From Drivers to Freelancers: Who Can Grab an Installment Loan?

Below various types of gig workers are shown who can apply for installment loans. However, qualification of loan typically depends upon factors like income, debt ratio, and other factors.

| Gig Worker Type | Typical Income Source | Eligibility Factors |

|---|---|---|

| Rideshare Drivers | Uber, Lyft, DoorDash payments | Consistent ride earnings, bank statements |

| Delivery Couriers Freelancers | Instacart, Postmates, Amazon Flex payouts | Regular delivery income, platform records |

| Freelancers | Client payments (e.g., Upwork, Fiverr) | 1099 forms, invoicing history, bank deposits |

| Task-Based Workers | TaskRabbit, Handy earnings | Task completion records, payment consistency |

| Online Sellers | Etsy, eBay, or Shopify sales | Sales receipts, PayPal/Venmo statements |

| Independent Contractors | Construction workers, Freelance writers, Graphic designers | IRS Form 1099-MISC or 1099-NEC |

You are working for the gig economy, but your gig platform not shown above? Don't worry, you can still apply for installment loans for gig workers with GigsPayday.

Top Options for Gig Works to Get Installment Loans

Options are limited, but there are still lenders who accept gig workers seeking instalment loans:

- GigsCheck: GigsCheck is a growing and dedicated platform offering online instalment loans for gig workers. Loan amounts range between $2,500 and $ 5000 with repayment time over 6-12 months.

- Fundo: Fundo offers flexible cash advances up to $10,000 for gig workers, self-employed, and small businesses.

- GigsHelp: GigsHelp comes under the top and best cash advance apps for rideshare and delivery drivers to get instant funds. Aside from cash advances, it also offers instalment loans for gig workers.

- Avant: Avant offers personal loans and credit cards ranging from $2,000 to $35,000 to gig workers and other individuals with flexible repayments.

- GigsPayday: Like GigsCheck, GigsPayday offer fast payday loans for gig workers up to $2,500 and instalment loans up to $5,000. It is a unique loan platform for gig workers, freelancers, and rideshare drivers to compare and apply online. It promises same-day funding within 10 minutes* after approval.

Best Tips for Gig Workers Applying for Installment Loans

To boost your chances of getting approval with better terms, consider the following tips:

- Check your credit score: No matter what credit score you earn, knowing it helps you target the right lenders. Some lenders accept low credit scores, while others allow lousy credit.

- Pre-arrange required documentation: Applications with no errors and missed information are always approved quickly. Make sure to arrange all the necessary documents like bank statements, personal details, and gig platform earnings to show as proof of income.

- Compare lenders & offers: Don't apply frequently and unthinkingly; shop around and compare lenders and their offers as much as possible to get the best deal.

- Borrow smart: Check your need for money and apply only for a loan amount you require, which you can repay later comfortably. Consider factors like your monthly gig earnings to determine how much loan you can repay.

When life throws you a curveball it's GigsPayday to the rescue

Need a gig worker loan? GigsPayday has you covered with no hidden fees, an application process with no credit check, and acceptance of all credit scores.

Apply NowFAQ's

Who can apply?

Typically, lenders who offer instalment loans for gig workers require income proof (e.g., bank statements, 1099s, or platform earnings), citizenship or residence of the U.S., valid ID, and an active checking account to get funds.

Are there instalment loans with bad credit?

Yes, some lenders offer instalment loans for gig workers with bad credit. Usually, no credit check and bad credit loans come with higher costs as compared to other loans designed for good credit individuals.

How much does it cost?

The overall cost of loans is explained while you are pursuing the application process. Usually, it depends upon your lender, loan amount, loan type, and how many instalments you would like to choose to repay your loan.

What can I use my gig worker instalment loan for?

- To repair your car/bike and keep earning.

- To buy a new laptop or software.

- To cover urgent mid-month medical bills.

- To consolidate high-interest debts.

- To learn new gig skills and expand income.

- To bridge a cash gap when gig work dries.

Can I repay my instalment loan early?

At GigsPayday, you can repay your instalment loan early and save on interest without paying extra costs or charges.